The Untapped Potential of Crowdfunding in Ghana

Crowdfunding—once viewed as a niche fundraising strategy—has become a global financial tool empowering entrepreneurs, creatives, and social changemakers to raise capital directly from the public. While crowdfunding platforms in the United States, Europe, and parts of Asia continue to fuel startups, community projects, and innovation, Ghana has only begun to scratch the surface of what this alternative financing model can achieve.

In a country where traditional funding routes are often limited by high interest rates, strict collateral requirements, and slow bureaucratic processes, crowdfunding presents a transformative opportunity. From small businesses seeking startup capital to communities fundraising for education, health, and social infrastructure, the potential is enormous yet largely untapped.

This editorial by The High Street Business explores with Accra Street Journal on why crowdfunding remains underutilized in Ghana, the opportunities it presents, the challenges holding it back, and what needs to be done for it to become a mainstream financial tool.

📢 GET A DETAILED ARTICLES + JOBS

Join SamBoad's WhatsApp Channel and never miss a post or opportunity.

1. Understanding Crowdfunding: A Modern Financial Solution

Crowdfunding involves raising small amounts of money from a large number of people, typically via digital platforms. There are four major types:

a. Donation-Based Crowdfunding

Supporters contribute without expecting anything in return. Common for:

-

Medical emergencies

-

Social causes

-

Community projects

-

Charity drives

b. Reward-Based Crowdfunding

Backers receive a product, service, or token of appreciation. Often used by:

-

Creatives

-

Startups

c. Equity Crowdfunding

Investors receive shares or ownership in the business. Suitable for:

-

Growth-focused startups

-

SMEs scaling operations

d. Debt Crowdfunding (Peer-to-Peer Lending)

Individuals lend money to businesses or individuals, often at negotiated rates.

Crowdfunding democratizes finance by removing traditional barriers and giving anyone with an idea or need the opportunity to raise capital directly.

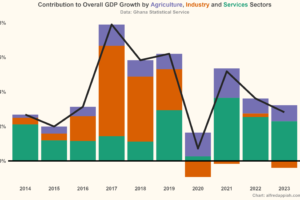

2. Why Crowdfunding Is Relevant for Ghana

Ghana’s financial ecosystem presents unique challenges that make crowdfunding an attractive alternative.

a. Bank Loans Remain Difficult to Access

Many Ghanaian SMEs struggle with:

-

High interest rates

-

Collateral demands (often properties)

-

Strict documentation procedures

-

Long approval times

Startups with no credit history or physical assets find it nearly impossible to secure bank funding.

b. Youth Unemployment and Entrepreneurial Growth

With more young people turning to entrepreneurship, access to early-stage capital—not ideas—is the biggest barrier. Crowdfunding can bridge this gap.

c. Community and Family-Oriented Culture

Ghanaians have a strong tradition of financial contribution through:

-

Susu groups

-

Church support

-

Family fundraising

-

Funeral contributions

Crowdfunding digitizes this communal spirit, making contributions faster, more transparent, and accessible.

d. Rise of Mobile Money and Digital Payments

Ghana’s fintech ecosystem enables mobile-based contributions, making the creation and management of crowdfunding platforms easier than ever.

3. The Untapped Sectors That Can Benefit from Crowdfunding

a. Startups and Small Businesses

Crowdfunding allows entrepreneurs to test ideas, validate products, and raise funds without debt. Those in:

-

Tech

-

Food processing

-

E-commerce

-

Artisan and creative industries

stand to benefit the most.

b. Agriculture

Farmers can raise funds for:

-

Farm inputs

-

Irrigation

-

Equipment

-

Storage and processing

Agri-crowdfunding models have succeeded in Nigeria and Kenya—Ghana can replicate this.

c. Creative and Entertainment Industries

Musicians, filmmakers, and content creators can use crowdfunding to finance:

-

Albums

-

Films

-

Art exhibitions

-

Events

d. Health and Emergency Support

Medical fundraising is already growing informally, but structured platforms can make it safer and more effective.

e. Education

Students needing:

-

Tuition fees

-

Laptop funds

-

Foreign scholarship support

can benefit immensely.

f. Social Infrastructure

Communities can crowdfund for:

-

Boreholes

-

School blocks

-

Clinics

-

Playgrounds

-

Road repairs

Crowdfunding increases transparency and community involvement.

4. Why Crowdfunding Has Not Yet Taken Off in Ghana

Several challenges prevent widespread adoption.

a. Limited Awareness

Many Ghanaians still do not fully understand how crowdfunding works or trust online fundraising.

b. Lack of Dedicated Local Platforms

Most fundraising is done on international platforms such as GoFundMe, which:

-

Don’t support mobile money

-

Have high processing fees

-

Face withdrawal challenges for African users

c. Trust Issues

Concerns about fraud and misuse of funds discourage people from donating.

d. Regulatory Gaps

The Securities and Exchange Commission (SEC) has begun looking into crowdfunding, especially equity crowdfunding, but regulations are still developing.

e. Cultural Pride

Some people avoid public fundraising due to fear of embarrassment or social judgment.

f. Payment Limitations

Not all platforms integrate Ghanaian payment systems like:

-

Mobile money

-

Local debit cards

-

Bank transfers

5. Opportunities for Growth

a. Local Crowdfunding Platforms

Platforms designed for Ghana’s local payment ecosystem can transform access to capital.

b. Government and Policy Support

Clear regulations will protect investors and build trust in equity crowdfunding.

c. Corporate Participation

Banks and fintech companies can partner with platforms to offer:

-

Verification services

-

Payment support

-

Monitoring tools

d. Social Media Amplification

Influencers, bloggers, and content creators can drive crowdfunding campaigns to wider audiences.

e. Diaspora Engagement

Ghanaians abroad are willing to support:

-

Community development

-

Family medical bills

-

Student tuition

Crowdfunding formalizes this support network.

6. What Needs to Happen for Crowdfunding to Thrive

a. Stronger Regulations

Rules governing:

-

Equity fundraising

-

Investor rights

-

Fraud prevention

are essential.

b. Transparency and Accountability Tools

Campaign creators should provide:

-

Regular updates

-

Financial breakdowns

-

Proof of use of funds

c. Education and Awareness

Public campaigns can explain the power and safety of crowdfunding.

d. Integration of Local Payment Systems

Mobile money support is non-negotiable for Ghanaian adoption.

e. Verification Systems

KYC processes reduce fraud and increase donor confidence.

7. The Future of Crowdfunding in Ghana

If properly harnessed, crowdfunding can:

-

Unlock capital for millions of SMEs

-

Stimulate youth entrepreneurship

-

Support social development

-

Accelerate innovation

-

Reduce dependency on bank loans

-

Build stronger communities

Crowdfunding can potentially become a major driver of Ghana’s economic transformation—one contribution at a time.

FAQs

**1. What is crowdfunding?

Crowdfunding is a method of raising money from a large number of people, usually online, to support a business idea, project, or personal need.

2. Is crowdfunding legal in Ghana?

Yes. Ghana permits most forms of crowdfunding, but equity crowdfunding awaits clearer regulations from financial authorities.

3. Why is crowdfunding still underdeveloped in Ghana?

Limited awareness, trust issues, lack of local platforms, and regulatory gaps contribute to slower adoption.

4. Can businesses use crowdfunding to raise capital?

Absolutely. SMEs and startups can use reward-based, debt, or equity crowdfunding to finance operations or expansion.

5. What is needed for crowdfunding to grow in Ghana?

Robust regulation, public education, mobile money integration, and verification systems

Source: The High Street Business

Disclaimer: Some content on The High Street Business may be aggregated, summarized, or edited from third-party sources for informational purposes. Images and media are used under fair use or royalty-free licenses. The High Street Business is a subsidiary of SamBoad Publishing under SamBoad Business Group Ltd, registered in Ghana since 2014.

For concerns or inquiries, please visit our Privacy Policy or Contact Page.