Ghana’s economic history is a story of cycles—periods of rapid growth followed by slowdowns, recovery phases interrupted by shocks, and reforms shaped by both internal policy choices and global forces. For businesses operating in Ghana today, especially small and medium-sized enterprises (SMEs), understanding these economic cycles is no longer optional. It is essential for survival, resilience, and long-term growth.

At The High Street Business, we view Ghana’s economic cycles not as abstract macroeconomic events but as real forces that directly shape pricing, consumer behaviour, access to finance, investment confidence, and business sustainability. Each cycle leaves behind lessons—some learned painfully, others ignored repeatedly.

Understanding Ghana’s Economic Cycles

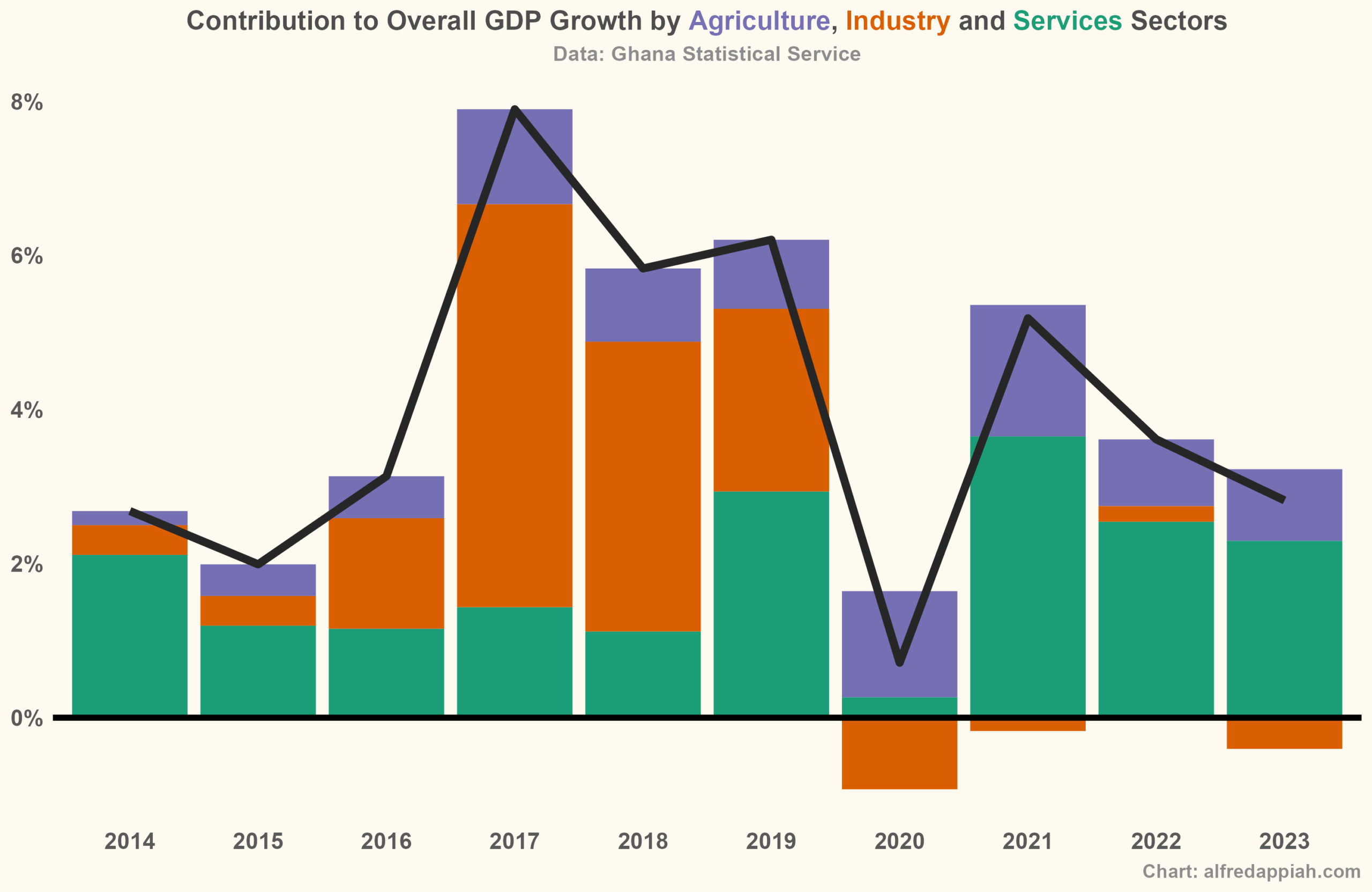

Ghana’s economy has historically moved through identifiable phases: expansion, overheating, correction, and stabilisation. These cycles are often influenced by commodity dependence (particularly gold, cocoa, and oil), fiscal policy decisions, currency pressures, debt accumulation, and external shocks such as global recessions or pandemics.

📢 GET A DETAILED ARTICLES + JOBS

Join SamBoad's WhatsApp Channel and never miss a post or opportunity.

Periods of economic expansion—such as those following oil production or debt relief initiatives—tend to encourage optimism. Businesses expand rapidly, consumer spending rises, and credit becomes more accessible. However, when growth is not matched with productivity gains, export diversification, and fiscal discipline, these expansions often lead to inflationary pressures and currency depreciation.

The correction phase usually follows, marked by rising interest rates, reduced consumer spending, tax adjustments, and tighter credit conditions. For many businesses, this is when weaknesses are exposed.

Lesson One: Growth Without Resilience Is Temporary

One of the most consistent lessons from Ghana’s economic cycles is that growth without resilience does not last. Businesses that expand aggressively during boom periods without building financial buffers often struggle when conditions tighten.

Historically, many Ghanaian enterprises increase overheads—larger offices, more staff, higher operating costs—during periods of economic optimism. When inflation rises or the cedi weakens, these fixed costs become unsustainable.

Resilient businesses, by contrast, are those that treat growth phases as opportunities to strengthen internal systems, diversify revenue streams, and improve operational efficiency rather than simply scale consumption.

Lesson Two: Inflation Is a Silent Business Risk

Inflation has been a recurring feature of Ghana’s economic cycles. While often discussed at the national level, its impact on businesses is deeply practical. Rising input costs, shrinking consumer purchasing power, and unpredictable pricing environments make long-term planning difficult.

Businesses that survive inflationary cycles are typically those that understand cost control, pricing strategy, and supply chain management. They monitor margins closely, renegotiate supplier terms where possible, and avoid price structures that rely on thin profit buffers.

Ignoring inflation as a “temporary issue” has repeatedly proven costly for businesses across retail, manufacturing, and services.

Lesson Three: Currency Volatility Rewards Prepared Businesses

Cedi depreciation has been one of the most disruptive features of Ghana’s economic cycles. For import-dependent businesses, exchange rate volatility can erase profits overnight. For exporters, it can create unexpected advantages.

The lesson is not to fear currency movements but to plan for them. Businesses that understand their exposure—whether through imported raw materials, foreign-denominated loans, or international clients—are better positioned to respond strategically.

Hedging mechanisms may not be accessible to all SMEs, but basic planning, such as pricing flexibility, local sourcing strategies, and foreign currency awareness, has proven critical across multiple economic cycles.

Lesson Four: Policy Shifts Are Predictable—If You Pay Attention

Another recurring theme in Ghana’s economic history is policy adjustment. Tax reforms, subsidy removals, regulatory changes, and fiscal tightening often follow periods of excessive spending or debt accumulation.

Businesses that closely track policy direction—rather than reacting after changes take effect—are better prepared. Economic cycles in Ghana have shown that government interventions rarely occur without warning signs, such as rising deficits, IMF negotiations, or public finance stress.

At The High Street Business, we consistently observe that businesses which align their strategies with policy realities—rather than political optimism—are more sustainable over time.

Lesson Five: Consumer Behaviour Changes with Every Cycle

Economic cycles reshape how Ghanaians spend. During growth phases, discretionary spending rises. During downturns, consumers prioritise essentials, value, and affordability.

Businesses that fail to adapt their offerings during downturns often experience sharp revenue declines. Those that succeed usually adjust product sizes, pricing models, payment options, or service delivery to reflect new consumer realities.

Understanding consumer psychology during economic stress is one of the most overlooked lessons from Ghana’s economic cycles.

Lesson Six: Access to Finance Is Cyclical—Plan Accordingly

Credit availability in Ghana expands and contracts with economic cycles. During growth periods, lending is more accessible. During corrections, interest rates rise, and banks become risk-averse.

Businesses that rely solely on borrowing during downturns often struggle. Those that build capital reserves, reinvest profits during good times, and maintain strong financial records are better positioned to access funding when conditions tighten.

Economic cycles repeatedly show that access to finance favours preparedness, not desperation.

Lesson Seven: Diversification Is Not a Luxury

Ghana’s economic history underscores the risks of over-reliance—whether on a single product, client, market, or revenue source. Businesses tied too closely to one sector or income stream are more vulnerable during economic shifts.

Diversification—across products, customer segments, or markets—has proven to be one of the most effective survival strategies across multiple economic cycles.

This lesson applies equally to micro-enterprises and large corporations.

The Bigger Picture for Ghanaian Businesses

Economic cycles are not signs of failure; they are features of developing and emerging economies. What matters is how businesses respond to them.

The most successful Ghanaian enterprises are not those that avoid downturns entirely but those that understand cycles, plan for volatility, and remain disciplined during both good and bad times.

At The High Street Business, we believe Ghana’s economic cycles offer clarity rather than confusion. They reveal which business models are resilient, which strategies are sustainable, and which assumptions need to change.

FAQs

What are economic cycles in Ghana?

Economic cycles refer to periods of growth, slowdown, correction, and recovery in Ghana’s economy, influenced by policy decisions, commodity prices, and global conditions.

Why should businesses study Ghana’s economic cycles?

Understanding cycles helps businesses plan better, manage risk, and remain resilient during downturns.

How do economic cycles affect SMEs in Ghana?

They influence consumer spending, access to finance, costs, pricing, and overall business stability.

Can businesses prepare for economic downturns?

Yes. Through cost control, diversification, financial discipline, and policy awareness.

Are economic cycles unique to Ghana?

No. However, Ghana’s cycles are shaped by its specific economic structure and policy environment.

Source: The High Street Business

Disclaimer: Some content on The High Street Business may be aggregated, summarized, or edited from third-party sources for informational purposes. Images and media are used under fair use or royalty-free licenses. The High Street Business is a subsidiary of SamBoad Publishing under SamBoad Business Group Ltd, registered in Ghana since 2014.

For concerns or inquiries, please visit our Privacy Policy or Contact Page.