The International Monetary Fund has approved the fifth review of Ghana’s Extended Credit Facility (ECF) programme, unlocking a US$380 million disbursement and reinforcing international confidence in the country’s reform trajectory. The decision, taken by the IMF Executive Board on December 17, 2025, marks another milestone in Ghana’s effort to restore macroeconomic stability after one of the most severe economic downturns in its recent history.

Beyond the immediate liquidity boost, the approval carries broader implications. It signals that Ghana’s policy direction—anchored in fiscal discipline, debt restructuring, and structural reforms—remains broadly on track. More importantly, it comes as the government prepares to pivot from stabilisation toward growth, jobs and improved living standards, a shift that analysts say will define the credibility of the 2026 Budget and the remainder of the IMF programme.

A Vote of Confidence From Washington

The IMF’s decision clears the way for the sixth tranche under the ECF arrangement and reflects what the Fund described as strong programme performance. Since entering the programme, Ghana has implemented difficult measures aimed at stabilising the currency, restoring confidence in public finances and rebuilding external buffers.

📢 GET A DETAILED ARTICLES + JOBS

Join SamBoad's WhatsApp Channel and never miss a post or opportunity.

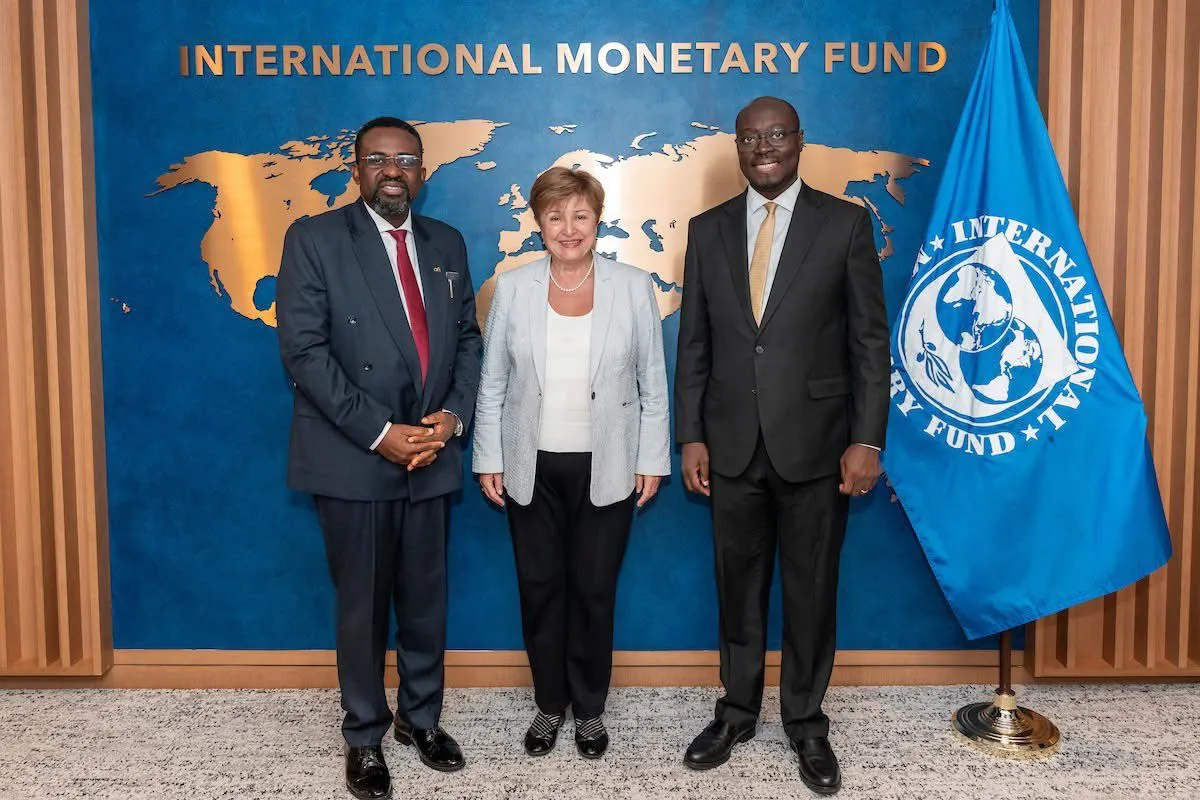

For Finance Minister Dr. Cassiel Ato Forson, the approval represents more than compliance with IMF benchmarks. “This is a strong confirmation that Ghana is firmly resetting for growth, jobs and economic transformation,” he said, describing the decision as a clear vote of confidence in the government’s reform agenda.

At the Bank of Ghana, officials see the disbursement as critical to sustaining macroeconomic gains already achieved. With inflation easing, exchange rate pressures moderating and fiscal balances improving, the authorities argue that the economy is entering a more predictable phase—one in which policy credibility matters as much as liquidity support.

From Crisis Management to Economic Reset

Ghana’s IMF programme was negotiated at a time of acute distress. By late 2022, the country was grappling with runaway inflation, rapid currency depreciation, unsustainable debt dynamics and shrinking investor confidence. The ECF programme was designed primarily to restore stability, not to deliver rapid growth.

Nearly three years on, the narrative is beginning to shift. Headline inflation has moderated significantly from its peak, fiscal deficits have narrowed, and the government has made progress on domestic and external debt restructuring. These developments formed the backdrop to the IMF’s latest review.

Yet the challenge ahead is fundamentally different. Stability, while necessary, is no longer sufficient. Businesses, households and investors are now looking for tangible improvements in incomes, employment and access to credit—outcomes that depend on how effectively Ghana translates macro gains into real economic activity.

What the $380 Million Means for Ghana

The immediate impact of the IMF disbursement will be felt in Ghana’s balance of payments. The inflow is expected to strengthen foreign exchange reserves, support currency stability and ease pressure on the cedi, particularly as import demand rises toward the end of the year.

It also provides budgetary breathing room at a time when fiscal space remains constrained. While IMF funds are not a substitute for domestic revenue mobilisation or private investment, they help anchor confidence, making it easier for Ghana to engage with other multilateral lenders and development partners.

Crucially, continued IMF backing also reassures markets that Ghana’s reform path remains credible—an important signal as the country seeks to rebuild access to international capital markets over the medium term.

The 2026 Budget: A Test of Credibility

The IMF approval coincides with growing scrutiny of the government’s 2026 budget strategy. According to KPMG and other analysts, the coming fiscal year will be pivotal in determining whether Ghana can convert macroeconomic stability into improved livelihoods.

The expectation is not a return to expansionary spending, but a rebalancing of priorities—toward targeted social protection, infrastructure that crowds in private investment, and policies that support productive sectors such as agriculture, manufacturing and services.

The government has already signalled that fiscal discipline will remain intact, even as it seeks to unlock growth. This balancing act—supporting the vulnerable without undermining hard-won stability—will shape both domestic confidence and the IMF’s assessment in subsequent programme reviews.

Monetary Policy and Financial Sector Stability

At the monetary level, the Bank of Ghana faces its own set of trade-offs. With inflation easing, pressure is mounting for a gradual reduction in interest rates to support credit growth. Yet policymakers remain cautious, aware that premature easing could reverse recent gains.

Governor Dr. Johnson Asiama has repeatedly emphasised the need for policy consistency, arguing that credibility is the central bank’s most valuable asset at this stage of the recovery. Financial sector stability, particularly following the domestic debt exchange, also remains a priority, as banks and pension funds continue to adjust their balance sheets.

The IMF’s endorsement of Ghana’s performance provides additional policy space, but it does not remove the need for careful calibration.

Structural Reforms: The Harder Phase

While fiscal and monetary targets dominate headlines, the hardest phase of the IMF programme lies in structural reforms. These include improving public financial management, strengthening state-owned enterprises, enhancing domestic revenue mobilisation and addressing inefficiencies in energy and public procurement.

Progress in these areas tends to be slower and less visible, yet they are critical for sustaining growth beyond the IMF programme. Investors will be watching closely to see whether reforms translate into a more predictable business environment, faster project execution and lower transaction costs.

The government has argued that initiatives under the 24-Hour Economy framework—including agro-industrial corridors, manufacturing hubs and logistics upgrades—are aligned with this structural agenda, aiming to link stability with productivity and job creation.

Investor Sentiment and the Road Ahead

For investors, the IMF’s fifth review approval reduces uncertainty but does not eliminate risk. Ghana’s recovery remains vulnerable to external shocks, including global interest rate movements, commodity price volatility and geopolitical tensions.

Nevertheless, the consistency of programme implementation is gradually reshaping perceptions. The message from Washington is clear: Ghana has met its commitments so far, and the reform process remains intact.

This matters not only for sovereign credibility but also for private sector decision-making. As confidence improves, businesses are more likely to commit capital, expand operations and hire workers—creating the virtuous cycle that policymakers are hoping to ignite.

From Endorsement to Outcomes

The IMF’s approval of the fifth ECF review and the release of US$380 million mark an important endorsement of Ghana’s reform efforts. But endorsements do not automatically translate into improved living standards.

The next phase of Ghana’s recovery will be judged less by compliance reports and more by outcomes: jobs created, costs reduced, incomes stabilised and opportunities expanded. The 2026 budget, and the policies that follow it, will determine whether the country can convert macroeconomic stability into broad-based growth.

For now, the IMF’s decision buys Ghana time—and credibility. What the government does with both will define the next chapter of the recovery.

Source: The High Street Business

Disclaimer: Some content on The High Street Business may be aggregated, summarized, or edited from third-party sources for informational purposes. Images and media are used under fair use or royalty-free licenses. The High Street Business is a subsidiary of SamBoad Publishing under SamBoad Business Group Ltd, registered in Ghana since 2014.

For concerns or inquiries, please visit our Privacy Policy or Contact Page.